Brazil Gets “Real” about Intervention

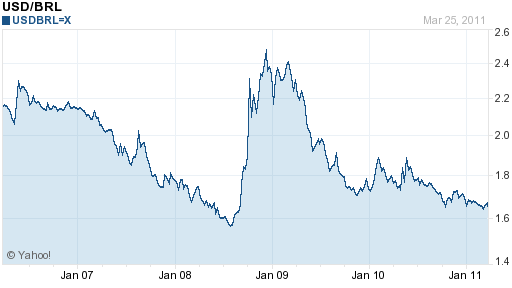

9:19 AM // 0 comments // Unknown // Category: ForexOver the last two years, the Brazilian Real has appreciated a whopping 37% against the US Dollar, second only to the South African Rand. It hasn’t been this strong since prior to the credit crisis, and it is rapidly closing in on a record high. If only Brazilian policymakers hadn’t made it a high priority to prevent that from happening.

The appreciation of the Real is being driven primarily by high interest rates, which in turn, are being driven by inflation. Brazilian prices are now rising at an annualized pace of 6%, which is well above the Bank of Brazil’s comfort zone. As a result, it has already raised rates several times in this cycle, including a 50 basis point hike at the beginning of this month. Its benchmark Selic rate now stands at a stratospheric 11.75%, which is higher than any other currency in the same tier.

Of course, the Bank of Brazil understands the implications of continuing to hike rates. With inflation as high as it is, however, it doesn’t really have much of a choice. Moreover, investors are betting on additional rate hikes, which means even wider interest rate differentials. When you also factor in a surprising lack of volatility surrounding the Real, it will certainly become an even more popular target currency for yield-hungry carry traders.

The government of Brazil, however, is doing everything in its power to repel this kind of speculation, lest it drive up the Real further and threaten the competitiveness of its export sector. In 2010, it tripled the tax rate on foreign investment in fixed income securities, to 6%. It increase scrutiny on local banks that have sought to borrow abroad. The national government has taken to doing more of its borrowing on the international market, and deposited the proceeds directly into its forex reserves, in order to mitigate the impact on the Real. The government is also contemplating punishing short-term investors by establishing a “lock-up” period for foreign capital.

And yet, Brazil finds itself in a quandary. While its trade balance has remained positive, its current account balance is now entrenched in deficit territory. Just like the US, it remaisn dependent on foreign investors to bridge this gap every month. Perennial budget deficits also mean the government can ill afford to alienate lenders. Finally, the government still wishes to attract legitimate foreign direct investment in infrastructure projects and portfolio investment in the stock market.

If Brazil is successful in limiting speculation – which is difficult, but not impossible given its determination – there is a chance that the Brazilian Real will hold steady. After all, Brazil saves less than it needs to invest, and inflation is high enough that there should be some natural downward pressure on the Real. On the other hand, if volatility remains low and speculators continue to find a way around the new capital controls (tempted by 11.75% short-term deposit rates), it will be difficult for the Central Bank to prevent its rise. It can only sit back, continue to hike rates, and pray that speculators soon lose interest.

Personally, I’m betting that the government of Brazil will achieve some measure of success, at least in the short-term. Of all the emerging-market countries engaged in the currency war, it seems to be the most resolute participant after China. At this point, short of fixing the Real to the Dollar, it has shown that it is willing to do whatever it takes to prevent speculators from winning.

Related posts :

0 comments for this post

Leave a reply

TOP POST

-

Euro is turning lower today, after some gains earlier. Now, though, the 17-nation currency is falling back as Forex traders try to determine...

-

The US dollar gained today as signs of an economic slowdown in China damped risk appetite of investors and made them to return to the safety...

-

Vietnam //

-

Name: Jin Mei XiEnglish name: Olwen Jin Date of birth: August 21, Place of birth: Shandong Province Yantai City, China Height: 175 cm Weig...

-

As you'll recall from yesterday, there was one small detail that stood out in Microsoft's announcement of a new preview program for...

-

Chinese Stunning Model Anata Wang Ying

-

Elly Tran Ha is an American-borned-Vietnamese, who has recently moved back to Vietnam from the USA. She works as a part-time model while fur...

-

The first of Dalao class was commissioned in 2010 and within one year, the second boat was launched. Quietly, PLAN's submarine force is ...

-

The Swiss franc was down for the second week as prospects of peg of the currency to the euro significantly reduced appeal of the fra...

-

Hot And Sexy Upcoming Actress Uthpala Madushani, Uthpala Madushani Hot, Uthpala Madushani Bikini, Uthpala Madushani sexy, Uthpala Madushan...

Total Pageviews

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.- SimplexPro template designed by Simplex Design.

- Powered by Blogger.com.