Fed Mulls End to Easy Money

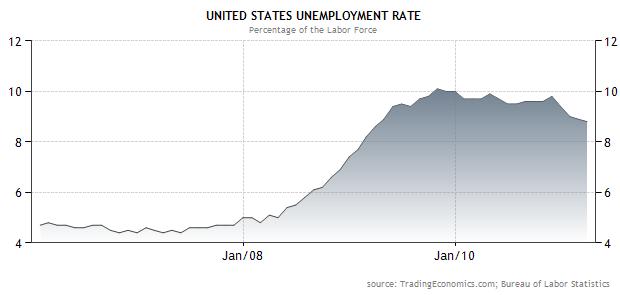

2:17 PM // 0 comments // Unknown // Category: ForexFirst of all, the economic recovery is gathering momentum. According to a Bloomberg News poll, “The US economy is forecast to expand at a 3.4 percent rate this quarter and 3.3 percent rate in the second quarter.” More importantly, the unemployment rate has finally begun to tick down, and recently touched an 18-month low. While it’s not clear whether this represents a bona fide increase in employment or merely job-hunting fatigue among the unemployed, it nonetheless will directly feed into the Fed’s decision-making process.

In fact, the Fed made such an observation in its March 15 FOMC monetary policy statement, though it prefaced this with a warning about the weak housing market. Similarly, it noted that a stronger economy combined with rising commodity prices could feed into inflation, but this too, it tempered with the dovish remark that “measures of underlying inflation continue to be somewhat low.” As such, it warned of “exceptionally low levels for the federal funds rate for an extended period.”

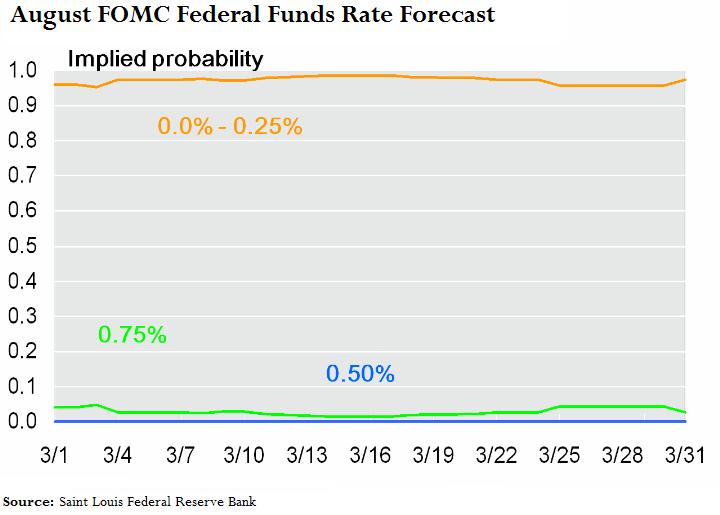

To be sure, interest rate futures reflect a 0% likelihood of any rate hikes in the next 6 months. In fact, there is a 33% chance that the Fed will hike before the end of the year, and only a 75% chance of a 25 basis point rise in January of 2012. On the other hand, some of the Fed Governors are starting to take more hawkish positions in the media about the prospect of rate hikes: “Minneapolis Federal Reserve President Narayana Kocherlakota said rates should rise by up to 75 basis points by year-end if core inflation and economic growth picked up as he expected.” Given that he is a voting member of the FOMC, this should not be written off as idle talk.

Meanwhile, Saint Louis Fed President James Bullard has urged the Fed to end its QE2 program, and he isn’t alone. “Philadelphia Fed President Charles Plosner and Richmond Fed President Jeffrey Lacker have also urged a review of the purchases in light of a strengthening economy and concern over future inflation.” While the FOMC voted in March to “maintain its existing policy of reinvesting principal payments from its securities holdings and…purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011,” it has yet to reiterate this position in light of these recent comments to the contrary, and investors have taken notice.

Assumptions will probably be revised further following tomorrow’s release of the minutes from the March meeting, though investors will probably have to wait until April 27 for any substantive developments. The FOMC statement from that meeting will be scrutinized closely for any subtle tweaks in wording.

Ultimately, the take-away from all of this is that this record period of easy money will soon come to an end. Whether this year or the next, the Fed is finally going to put some monetary muscle behind the Dollar.

wait

Related posts :

0 comments for this post

Leave a reply

TOP POST

-

Euro is turning lower today, after some gains earlier. Now, though, the 17-nation currency is falling back as Forex traders try to determine...

-

The US dollar gained today as signs of an economic slowdown in China damped risk appetite of investors and made them to return to the safety...

-

Vietnam //

-

Name: Jin Mei XiEnglish name: Olwen Jin Date of birth: August 21, Place of birth: Shandong Province Yantai City, China Height: 175 cm Weig...

-

As you'll recall from yesterday, there was one small detail that stood out in Microsoft's announcement of a new preview program for...

-

Chinese Stunning Model Anata Wang Ying

-

Elly Tran Ha is an American-borned-Vietnamese, who has recently moved back to Vietnam from the USA. She works as a part-time model while fur...

-

The first of Dalao class was commissioned in 2010 and within one year, the second boat was launched. Quietly, PLAN's submarine force is ...

-

The Swiss franc was down for the second week as prospects of peg of the currency to the euro significantly reduced appeal of the fra...

-

Hot And Sexy Upcoming Actress Uthpala Madushani, Uthpala Madushani Hot, Uthpala Madushani Bikini, Uthpala Madushani sexy, Uthpala Madushan...

Total Pageviews

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.- SimplexPro template designed by Simplex Design.

- Powered by Blogger.com.