Forex Markets Focus on Central Banks

1:31 PM // 0 comments // Unknown // Category: ForexThe currency wars may have subsided, but they haven’t ended. On both a paired and trade-weighted basis, the Dollar is declining rapidly. As a result, emerging market Central Banks are still doing everything they can to protect their respective currencies from rapid appreciation. As I’ve written in earlier posts, most Latin American and Asian Central Banks have already announced targeted strategies, and many intervene in forex markets on a daily basis. If the Japanese Yen continues to appreciate, you can bet the Bank of Japan (perhaps aided by the G7) will quickly jump back in.

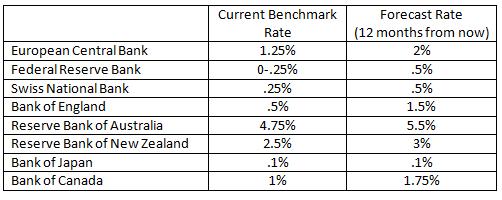

Then there are the prospective rate hikes, cascading across the world. Last week, the European Central Bank became the first in the G4 to hike rates (though market rates have hardly budged). The Reserve Bank of Australia, however, was the first of the majors to hike rates. Since October 2009, it has raised its benchmark by 175 basis points; its 4.75% cash rate is easily the highest in the industrialized world. The Bank of Canada started hiking in June 2010, but has kept its benchmark on hold at 1% since September. The Reserve Bank of New Zealand lowered its benchmark to a record low 2.5% as a result of serious earthquakes and economic weakness.

Going forward, expectations are for all Central Banks to continue (or begin) hiking rates at a gradual pace over the next couple years. If forecasts prove to be accurate, the US Federal Funds Rate will stand around .5% at the beginning of 2012, tied with Switzerland, and ahead of only Japan. The UK Rate will stand slightly above 1%, while the Eurozone and Canadian benchmarks will be closer to 2%. The RBA cash rate should exceed 5%. Rates in emerging markets will probably be even higher, as all four BRIC countries (Russia, Brazil, China, India) should be well into the tightening cycles.

On the one hand, there is reason to believe that the pace of rate hikes will be slower than expected. Economic growth remains tepid across the industrialized world, and Central Banks are wary about spooking their economies with premature rate hikes. Besides, Fed watchers may have learned a lesson as a result of a brief bout of over-excitement in 2010 that ultimately led to nothing. The Economist has reported that, “Markets habitually assign too much weight to the hawks, however. The real power at the Fed rests with its leaders…At present they are sanguine about inflation and worried about unemployment, which means a rate rise this year is unlikely.” Even the ECB disappointed traders by (deliberately) adopting a soft stance in the press release that accompanied its recent rate hike.

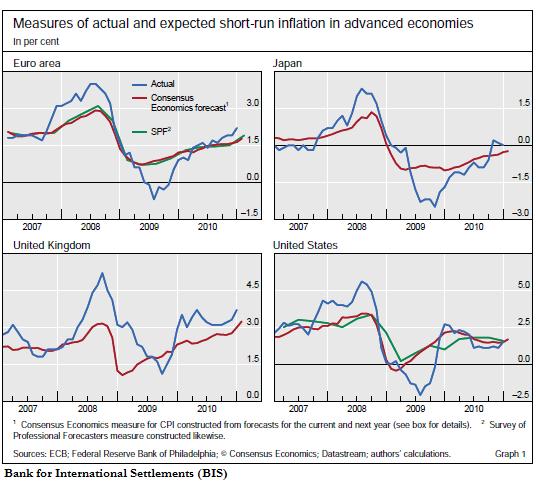

On the other hand, a recent paper published by the Bank for International Settlements (BIS) showed that the markets’ track record of forecasting inflation is weak. As you can see from the chart below, they tend to reflect the general trend in inflation, but underestimate when the direction changes suddenly. (This is perhaps similar to the “fat-tail” problem, whereby extreme aberrations in asset price returns are poorly accounted for in financial models). If you apply this to the current economic environment, it suggests that inflation will probably be much higher-than-expected, and Central Banks will be forced to compensate by hiking rates a faster pace.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.In short, given the enhanced ability of Central Banks to dictate exchange rates, traders with long-term outlooks may need to adjust their strategies accordingly. That means not only knowing who is expected to raise interest rates – as well as when and by how much – but also monitoring the use of their other tools, such as balance sheet expansion, efforts to cool asset price bubbles, and deliberate manipulation of exchange rates.

wait

Related posts :

0 comments for this post

Leave a reply

TOP POST

-

Euro is turning lower today, after some gains earlier. Now, though, the 17-nation currency is falling back as Forex traders try to determine...

-

The US dollar gained today as signs of an economic slowdown in China damped risk appetite of investors and made them to return to the safety...

-

Vietnam //

-

Name: Jin Mei XiEnglish name: Olwen Jin Date of birth: August 21, Place of birth: Shandong Province Yantai City, China Height: 175 cm Weig...

-

As you'll recall from yesterday, there was one small detail that stood out in Microsoft's announcement of a new preview program for...

-

Chinese Stunning Model Anata Wang Ying

-

The first of Dalao class was commissioned in 2010 and within one year, the second boat was launched. Quietly, PLAN's submarine force is ...

-

Elly Tran Ha is an American-borned-Vietnamese, who has recently moved back to Vietnam from the USA. She works as a part-time model while fur...

-

The Swiss franc was down for the second week as prospects of peg of the currency to the euro significantly reduced appeal of the fra...

-

Hot And Sexy Upcoming Actress Uthpala Madushani, Uthpala Madushani Hot, Uthpala Madushani Bikini, Uthpala Madushani sexy, Uthpala Madushan...

Total Pageviews

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.

2008 - 2009 SimplexDesign. Content in my blog is licensed under a Creative Commons License.- SimplexPro template designed by Simplex Design.

- Powered by Blogger.com.